Understanding financial valuation requires grasping key concepts, including the present value of a perpetuity (PV). Warren Buffett, a legendary investor, emphasizes long-term value assessment, a principle directly relevant to perpetuity calculations. This concept finds practical application in analyzing corporate bonds, where predictable cash flows are often modeled as perpetuities. The discount rate, a vital component of the pv of a perpetuity formula, reflects the time value of money. Therefore, mastering the pv of a perpetuity formula provides a solid foundation for making informed investment decisions.

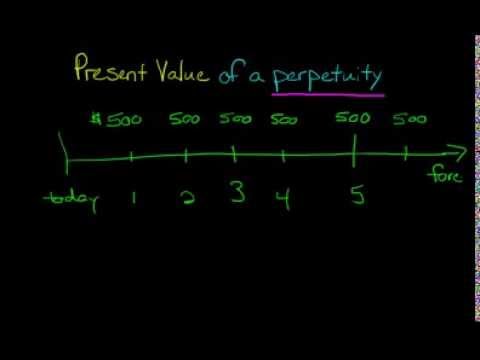

Image taken from the YouTube channel Edspira , from the video titled Present Value of a Perpetuity .

Understanding the Present Value of a Perpetuity Formula

This guide provides a comprehensive breakdown of the present value of a perpetuity formula, explaining its components, calculation, and practical applications. A perpetuity represents a stream of consistent cash flows that continue indefinitely. Therefore, calculating its present value is crucial for financial planning, investment analysis, and real estate valuation.

What is a Perpetuity?

A perpetuity is an annuity that has no end date. In simpler terms, it’s a series of equal payments that are expected to continue forever.

- Examples of perpetuities are rare in their purest form, but preferred stock dividends and certain types of bond payments can be considered close approximations, especially when viewed over a long time horizon.

The Importance of Calculating Present Value

The present value (PV) represents the current worth of a future stream of cash flows, discounted at an appropriate rate. This allows investors and analysts to compare the value of different investments or financial obligations, accounting for the time value of money. Money received today is worth more than the same amount received in the future because of its potential earning capacity. Therefore, understanding and calculating the present value of future cash flows, especially those associated with a perpetuity, is essential for making informed financial decisions.

The PV of a Perpetuity Formula Explained

The core formula for calculating the present value of a perpetuity is relatively straightforward:

PV = C / r

Where:

- PV = Present Value of the Perpetuity

- C = Periodic Cash Flow (the amount of the payment received each period)

- r = Discount Rate (the rate of return required to compensate for the risk of receiving the cash flow in the future)

Understanding the Components

Let’s dissect each element of the pv of a perpetuity formula to ensure a clear understanding:

-

Periodic Cash Flow (C): This represents the consistent amount of money received in each period (e.g., annually, monthly). It’s crucial that the cash flow is consistent for the perpetuity formula to be accurate.

-

Discount Rate (r): This reflects the opportunity cost of capital and the risk associated with the investment. A higher discount rate indicates a higher level of risk or a greater opportunity cost, resulting in a lower present value. The discount rate is typically expressed as a decimal (e.g., 5% = 0.05). Selecting the correct discount rate is critical to accurately calculating the pv of a perpetuity formula.

Formula Assumptions

It’s crucial to note the underlying assumptions that are inherent in the pv of a perpetuity formula:

- Constant Cash Flow: The formula assumes that the cash flows are consistent and will remain the same indefinitely. Any significant deviations in cash flow will necessitate using alternative valuation methods.

- Constant Discount Rate: Similarly, the discount rate is assumed to remain constant over the entire duration of the perpetuity. Changes in interest rates or perceived risk could affect the accuracy of the calculation.

Calculating PV of a Perpetuity: Step-by-Step

Let’s illustrate how to calculate the present value of a perpetuity using a practical example:

-

Identify the Periodic Cash Flow (C): Let’s say you are promised an annual payment of $1,000 indefinitely. Therefore, C = $1,000.

-

Determine the Discount Rate (r): Assume that the appropriate discount rate for this investment is 8% (or 0.08).

-

Apply the Formula: Using the pv of a perpetuity formula, PV = C / r, we calculate: PV = $1,000 / 0.08 = $12,500.

Therefore, the present value of this perpetuity is $12,500. This implies that an investor would be willing to pay $12,500 today for the right to receive $1,000 per year forever, given an 8% discount rate.

Scenarios and Examples

To solidify your understanding, let’s consider a few more scenarios:

-

Example 1: Preferred Stock Dividends: A company offers preferred stock that pays a fixed annual dividend of $5 per share. If the required rate of return is 6%, then the present value of this perpetuity would be $5 / 0.06 = $83.33 per share.

-

Example 2: Endowment Fund: An endowment fund promises to distribute $50,000 annually for scholarships. If the fund’s expected rate of return is 4%, the present value of this perpetuity is $50,000 / 0.04 = $1,250,000.

Factors Affecting the PV of a Perpetuity

Several factors can influence the present value of a perpetuity, primarily centered around the periodic cash flow and the discount rate:

-

Changes in the Discount Rate: An increase in the discount rate will decrease the present value of the perpetuity, and vice-versa. This is because a higher discount rate implies a higher opportunity cost or risk, making future cash flows less valuable in today’s terms.

-

Changes in the Periodic Cash Flow: A higher periodic cash flow will increase the present value of the perpetuity, and vice-versa. The present value is directly proportional to the cash flow received each period.

The table below illustrates how changes in the discount rate affect the present value, assuming a constant cash flow of $1000:

| Discount Rate (r) | Present Value (PV) |

|---|---|

| 5% (0.05) | $20,000 |

| 8% (0.08) | $12,500 |

| 10% (0.10) | $10,000 |

Limitations of the Perpetuity Formula

While the pv of a perpetuity formula is a valuable tool, it’s essential to recognize its limitations:

-

The assumption of perpetual payments: In reality, very few cash flows are truly perpetual. Business models change, and economic conditions fluctuate. Applying the perpetuity formula to investments with a high probability of termination can lead to inaccurate valuations.

-

The assumption of a constant discount rate: Interest rates and perceived risk can change over time. Therefore, using a single discount rate for the entire perpetuity period may not be realistic.

-

Difficulty in accurately estimating the discount rate: Determining the appropriate discount rate can be subjective and dependent on various factors. An inaccurate discount rate will significantly affect the calculated present value.

When to Use (and When Not to Use) the Formula

The pv of a perpetuity formula is most useful in situations where:

- Cash flows are expected to continue for a very long time, nearing a perpetuity.

- Cash flows are relatively stable and predictable.

- A reasonable estimate of the discount rate is available.

Conversely, the formula should be avoided when:

- Cash flows are expected to terminate within a foreseeable period.

- Cash flows are highly variable or unpredictable.

- There is significant uncertainty regarding the appropriate discount rate.

In cases where the perpetuality assumption doesn’t hold, other valuation methods, such as discounted cash flow (DCF) analysis with a finite horizon, are more appropriate.

FAQs: Understanding the PV of Perpetuity Formula

Have questions about calculating the present value of a perpetuity? This FAQ section aims to address common queries and clarify the application of the PV of perpetuity formula.

What exactly does "perpetuity" mean in this context?

A perpetuity refers to a stream of cash flows that continues indefinitely. Think of it as an investment that pays out regularly forever. The pv of a perpetuity formula helps us determine the present-day value of such an endless stream of payments.

How is the PV of a perpetuity formula different from the PV of an annuity formula?

The key difference lies in the duration. An annuity has a fixed term, meaning payments stop after a specific period. A perpetuity, however, is perpetual, with payments continuing forever. The pv of a perpetuity formula reflects this infinite timeline.

What are the key inputs needed to calculate the present value of a perpetuity?

You need two primary inputs: the periodic payment amount and the discount rate (also known as the required rate of return). The discount rate reflects the time value of money and the risk associated with the investment. The pv of a perpetuity formula divides the payment amount by the discount rate.

Can the PV of a perpetuity formula be applied to real-world scenarios?

Yes, although true perpetuities are rare. It’s often used to approximate the value of long-term investments like preferred stock with fixed dividends, or certain government bonds that have no maturity date. Remember that this assumes the payments will indeed continue indefinitely for the pv of a perpetuity formula to be accurate.

So, there you have it – a clearer picture of the pv of a perpetuity formula! Hopefully, you can now use this info to make better financial decisions. Best of luck out there!